AISP and PISP: Roles, Responsibilities, and Impact on Open Banking

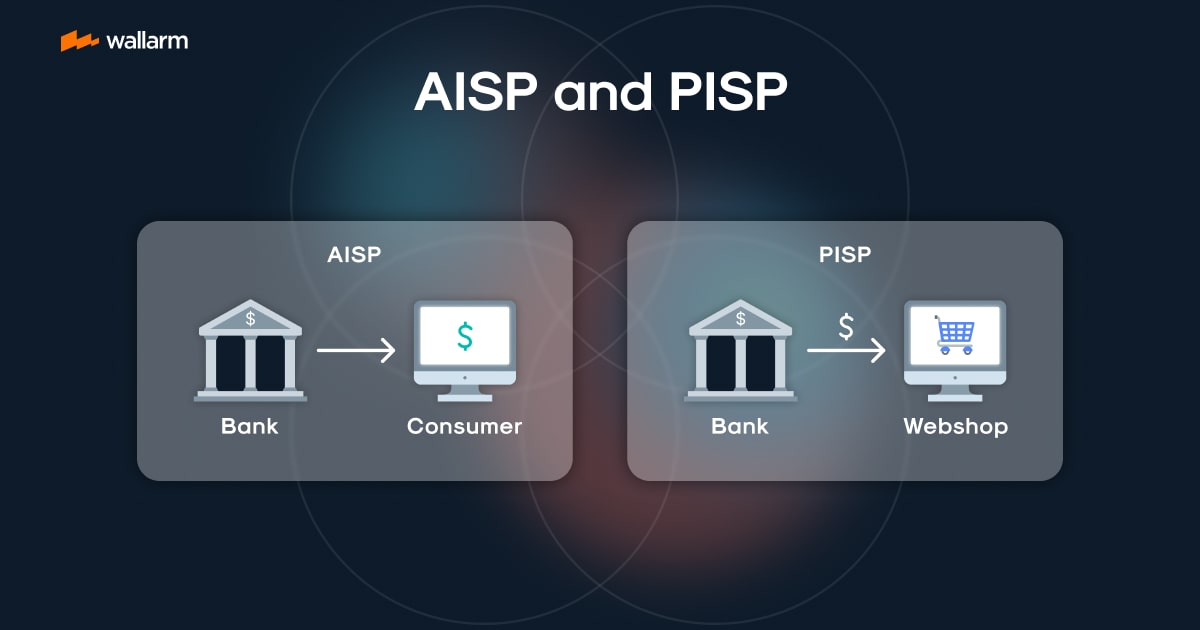

Within the landscape of unfettered or "open" banking, two fundamental components come into view; Payment Initiation Service Providers (PISP) along with Account Information Service Providers (AISP). Each relies on their inherent APIs- PISP API and AISP API respectively. These provide a conduit facilitating interaction between financial institutions and third-party players.

What is PISP API: Conducting Payments

The digitally-enabled PISP API offers the means for third-party players to activate payments aligning with customer requirements. It acts as a digital liaison connecting a customer's banking platform with the payment receiver, streamlining funds' transfer, eliminating reliance on intermediaries like credit or debit cards.

To contextualize, consider an online sale. The PISP API capability allows for direct payment to be remitted from the buyer's banking platform to the seller's platform. In this manner, it steps over the need for the conventional transaction gateways, thereby lowering costs as well as transaction durations.

What is AISP API: A Portal to Account Details

Counterpart to the PISP API, the AISP API equips third-party entities with the facility to access customer's account stats. Pertinent data at their disposal include transaction chronology, overall account balance, and expenditure patterns.

Given the customer's approval, the AISP API can extract this data from the bank and relay it to the third-party entity. This creates an avenue for the evolution of progressive financial services inclusive of budget-oriented applications, financial strategy applications, and bespoke financial counsel.

Comparative analysis: PISP API vs. AISP API

Symbiosis of PISP and AISP

While both PISP API and AISP API exhibit distinct functionalities, they synergize to augment the user's banking journey. A financial strategy tool may employ the AISP API to accumulate intel on user's purchasing patterns, thereby curating personalized financial counsel and budget strategies.

On acceptance of this strategy, the PISP API enters the scene. The user may use the tool to initiate payments that comply with the new budget strategy, with the PISP API enabling these transactions directly from the customer's banking platform.

Indivisibly, the PISP API alongside AISP API thus create a holistic financial management provision, enabling customers to manage their financial journey.

The potency of APIs in Open Banking Universe

Through their specific roles- facilitating unmediated payments and opening access to account details- the PISP API and AISP API represent potent elements in the open banking universe. By enhancing customers interaction with innovative third-party financial services, they gratify a user's banking requirements.

The synergy of these APIs creates a fluid, consolidated and customized approach to handling finances, paving the way for a progressive banking experience.

PISP Interface: A Catalyst for Streamlined Commerce Interactions

The PISP Interface plays a pivotal role in enhancing the functionality of open finance models. This innovative mechanism streamlines the process of transferring capital directly from an individual's bank deposit, thereby sidelining the need for traditional funding modes such as charge or bank cards.

In its functionality, the PISP Interface engenders a conduit between the individual, their banking institution, and the merchandiser. The function it performs is to enable the individual to engage the PISP in dispatching payment directly from their deposit to the merchandise provider's account. This leads to the PISP broadcasting a pay solicitation to the person's bank, and upon receiving the go-ahead from the bank, the resources promptly get transmitted to the merchandiser's deposit.

Utilizing the PISP Interface instead of regular payment workflows:

- Cost-Effective: Bypassing the network of card schemes translates into reduced transaction expenses for both merchants and customers.

- Enhanced Security: The PISP Interface applies robust client verification protocols, ensuring only the valid account holder can authorize the fund dispatch.

- Efficient: The immediacy of the PISP Interface accelerates payments, which serves to improve the liquidity of merchants along with the comfort of customers.

AISP Interface: Facilitator of Finance Data

Contrariwise, the AISP Interface offers a reliable and uniform path for third-party applications (TPAs) to tap into individuals' account information. Via this Interface, TPAs can collect and collate records from multiple banking accounts, offering the user a comprehensive snapshot of their fiscal health.

In this set-up, the individual, their bank, and the TPA formulate a three-pronged relationship. The user allows the TPA to access their account details. The TPA, in turn, sends a solicitation to the user's bank, and upon its affirmation, the necessary data is divulged.

Opting for the AISP Interface comes with its perks:

- Transparency: The AISP Interface endows individuals with an omnidirectional perspective of their monetary situation, aiding in making informed financial judgments.

- Bespoke Solutions: By compiling information from numerous banking accounts, the AISP Interface allows TPAs to dispense customized financial offerings.

- Innovation Friendly: The AISP Interface seeds avenues for TPAs to create avant-garde finance products and services.

Direct Comparison: PISP Interface vs. AISP Interface

While the roles and advantages of PISP Interface and AISP Interface in open banking may vary, both are crucial. The following table provides a comparative analysis of these two interfaces:

Therefore, PISP Interface and AISP Interface play decisive roles in revolutionizing financial interaction and resource allocation strategies, promising scope for creative financial solutions.

Open banking progression hinges on the vital use of APIs that serve as core connectors between different financial data repositories. Two main forces spearhead this transition: PISP overseers and AISP custodians. Such elements facilitate the ability of Third-Party Entities (TPEs) to pull up financial data and prompt transactions, building a sturdy groundwork for open banking operations.

The PISP API, in particular, harmonizes perfectly with the movement towards open banking by empowering TPEs to trigger transactions directly from a customer's financial source. This is made possible only after the customer grants approval resulting in a simplified transactions process and decreasing reliance on cards.

Peering into the working of a PISP API, it acts as a trusted medium for communication linking the TPE and the customer's bank. Once the customer gives the nod, transactions fire up directly from their account.

There are several advantages tethered to PISP API usage:

- Enhancing the ease of payment interactions.

- Reducing the risks connected with card-related deceit.

- Streamlining transaction handling times.

- Propelling opportunities for TPEs to roll out creative payment alternatives.

Meanwhile, AISP APIs equip TPEs with a pathway to access customer bank account details, such as transaction records, balance, and various financial specifics. Provided the customer agrees, AISP APIs pave a secure path for TPEs to extract and use these data.

Mode of operation for the AISP API revolves around constructing a secure communication link between the TPE and the bank. Post customer's approval, the TPE gains access to account specifics.

Here's a gist of the AISP API workflow:

Using AISP API has its utility:

- Equips TPEs with a platform for providing bespoke financial counsel.

- Gives customers a holistic view of their financial condition.

- Upsurges financial dealings' transparency.

- Avails a stage for TPEs to innovate around financial management.

A snapshot to differentiate PISP API and AISP API functionalities:

Both these APIs are pivotal for the smooth conduct of open banking. They amplify customer experiences and enable TPEs to push their innovation frontiers offering elaborate financial solutions. Their contribution towards open banking's momentum is irrefutable.

Enhanced Transactions through Revolutionary PISP API

Fintech sector's transformational expeditions have illuminated PISP API as a crucial breakthrough. This state-of-the-art technology grants authorization to non-banking entities, namely Third-Party Providers (TPPs), to initiate transactions, independent of the client's card usage. Rather, the transactions bypass this conventional avenue, leading directly from the user's bank account.

Incorporating PISP API into the conventional payment structure introduces several benefits. It eliminates intermediaries, ushering in a streamlined, efficient transactional journey and reducing associated costs. It further fortifies security by triggering transactions straight from the bank account. This elimination of the need for sharing sensitive card details in turn diminishes the risk of fraud occurrences.

By incorporating PISP API into the transactional journey, a hallmark advantage emerges - simplicity in practice. Clients can orchestrate transactions from their individual bank accounts, aldus excluding the necessity to operate on banking platforms or utilize bank cards. This, in effect, cultivates a superior payment experience for clients.

Exploiting Account Data through AISP API

Harnessing the power of AISP API, TPPs can now access and analyze a customer's banking data, dissolving the age-old barriers of traditional banking. A client's transaction history, live account balance, and spending patterns are now readily available insights. These insights illuminate possible avenues of growth and opportunities for clients.

TPPs, armed with the insights gleaned from the AISP API, can offer bespoke financial advice, aiding clients in optimizing their financial stewardship. Furthermore, it empowers the creation of customized financial products, spanning loans to insurance, shaped to reflect the client's distinct financial status.

Importantly, the AISP API facilitates merging of information across diverse bank accounts. For those managing multiple accounts across different banks, it offers a consolidated snapshot of their financial affairs, promoting proficient financial governance from a unified platform.

PISP API and AISP API- A Synergetic Duo

By amalgamating the utility of PISP API, which simplifies transaction management, with the AISP API, that architects tailored financial solutions, they collaboratively generate a superior customer-oriented banking experience. This synergistic duo morphs digital banking into an affordable, secure, and customer-centric endeavor.

In the arena of open banking, the APIs utilized are PISP (Payment Initiation Service Provider) and AISP (Account Information Service Provider). These tools amplify the defense strategies in the banking sector, particularly devised to safeguard data journey, and consequently act as a shield for bank platforms and consumer data against foreseeable security issues.

The Role of PISP API in Boosting Security Layer

In solidifying security defenses in open banking, PISP API holds the front line. This API effectively launches payments directly from user's bank accounts, eliminating the need for extraneous third-party payment arbitrators, and thereby curbing risks affiliated with data leaks.

Key security aspects of PISP API include:

- Rigorous User Verification: As mandated by the Revised Payment Service Directive (PSD2), PISP API employs at least two independent sources of verification to validate a user's identity. Examples of these sources are user-specific knowledge (like a password), user-owned item (like a smartphone), or a unique biological feature (such as a fingerprint).

- Encrypted Dialogue: By leveraging Transport Layer Security (TLS), PISP API ensures a secured communication channel between customers, banks, and the PISP, encrypting data during transit and preventing any unauthorized data capture.

- Data Minimization: PISP API is specifically designed to only request necessary data to initiate a payment, hence reducing the risk of critical data exposure in case of a security compromise.

Elevating Account Data Protection with AISP API

AISP API confidently enables third-party providers (TPPs) to access user account data. This may include transaction history and account balance details. Similar to the PISP API, AISP API secures sensitive information within stringent security protocols.

Key defense elements of AISP API comprise:

- Access Control: AISP API permits access to users' account data only after acquiring explicit user consent. This feature ultimately entrusts data control to the user and thus escalates the protection levels.

- Encrypted Data Protection: AISP API employs advanced encryption methods to protect user account details, thereby ensuring data remains decipherable only with the correct decryption key – even in an event of breach.

- Periodic Auditing: AISP API continually undergoes critical review processes to maintain exceptional security standards and to identify and correct any concealed security flaws.

The Co-existence of PISP API and AISP API in Security Hyde Park

After observing PISP API's and AISP API's pivotal roles in defining security measures, it's clear that their modes of operation differ. Here’s a side-by-side view of their significant security aspects:

In essence, both APIs contribute to bolstering security frameworks in open banking. Their joint efforts facilitate safe data transmission and provide a protective layer for bank operating systems and their clients against potential security breaches.

Paving the Way for Digital Payments with PISP API

PISP API is revolutionizing the transaction landscape by presenting a conduit right from the user's bank to third-party vendors (TPPs). This eradicates the need for credit or debit cards, hence contributing to a seamless payment process and lower transaction expenses. Visualize an online shopper making a purchase - while the conventional method insists on feeding in card information, PISP enables the buyer to choose PISP mode. Immediately, the API liaises with the purchaser's bank, consecrating the transaction and expediently updating the verification. This integration of the banking function in the realm of online buying fosters ease of use and bolsters customer gratification.

Enhancing Financial Management with AISP API

Conversely, the AISP API bestows TPPs with permissions to delve into customer account particulars. This includes previous transactions, existing account balance, and other financial statistics. Capitalizing on this data, TPPs can offer customized monetary supervisory services to their users. A plausible example would be a money management app leveraging AISP API to deliver users an exhaustive understanding of their financial status, comprising diverse bank balances, past transactions, spending patterns, and more. This amplifies financial insight, encouraging prudent financial judgments and proficient management of funds.

Analogy: PISP API & AISP API

Refining User Interaction with PISP and AISP APIs

PISP and AISP APIs used in unison have the promise of bringing an exponential improvement in digital client interaction. Consider a TPP deploying the AISP API for dissecting a user's expenditure habits, and simultaneously employing PISP API for triggering periodic bill payments. Such an approach could potentially smoothen financial management for the user by augmenting accessibility and efficiency. Incorporation of PISP and AISP APIs could bring about a radical transformation in financial procedures by uncomplicating payment processes and intensifying financial insight – giving birth to a fluid, bespoke digital banking journey.

Paving the Way for Effortless Transactions: PISP API

PISP API, short for Payment Initiation Service Provider API, forms a significant cog in the financial sector's gear. This pathbreaking invention forms a communicative link between users' banking platforms and recipients, enabling efficient transfer of funds. By facilitating direct financial transactions through a user's banking institution, PISP API spells the end of card-based transactions and revolutionizes the payments landscape.

Adopting this mode, users can choose to make payments via their reliable PISP, which then connects to their respected banking institution. It necessitates a rigorous identity validation process that follows, during which the PISP API notifies the user's bank about the initiated transaction. Ensuring the designated recipient is aware of the completed transaction aids in heightened security, streamlines processes, and fosters swift execution.

Leveraging In-depth Banking Information: AISP API

Breaking down the acronym, AISP API is the Account Information Service Provider API in play. The advent of AISP API empowers Third Party Providers (TPPs) to tap into comprehensive banking data, ranging from transaction history to account stability along with other vital details. Access to such information allows TPPs to enrich their service portfolio to include financial regulation considerations, budgetary tracking mechanisms, and personalized financial advisories. Thus moving beyond being mere service providers to becoming instrumental in adding value.

The primary role of an AISP API centers on forging a secure connective pathway between the financial institution and the TPP. Given the customer's approval, TPPs can delve into necessary banking data, establishing a solid groundwork for a plethora of services that positively transforming the customer's financial management experience, making it more intuitive and user-centric.

Distinct Characteristics: PISP API vs. AISP API

The Profound Influence of PISP API and AISP API in Banking

The introduction of PISP API and AISP API in the financial sphere has heralded a transformative era for financial services. By presenting a frictionless transactional interface and smooth data exchange, these APIs refine the user's banking journey, heighten process efficiency, and catalyze innovation.

- Elevating User Interface: The APIs champion direct payments from banking accounts and assimilate numerous ancillary services, carving out an upraised user experience.

- Boosting Operational Expertise: By eliminating multiple platform interactions, these APIs trim down transactional processes, augmenting efficiency and financial viability.

- Fostering Innovation: They put forth a secure, well-regulated channel for information exchange, spurring creativity, and pioneering service generation, thereby pushing the boundaries of traditional banking paradigms.

Transformation Triggered by PISP API in the Financial Sector

Welcoming PISP API to the finance realm has caused significant alterations. One key progression involves payment-initiation outside the conventional banking environment, directly from a user's asset store. This occurs in place of the old-school credit and debit transactions causing ripple-like disruptions across finance.

- Reduced Transaction Charges: PISP API pushes transaction intermediaries out of the picture, consequently cutting down linked costs. This may potentially lighten the financial burden on the end-user, heightening the accessibility of banking advantages.

- Amplified Competitive Tension: This API hands new-age finance ventures a level platform to contend with longstanding financial establishments. The escalation of such competition could afford customers superior services at fair prices.

- Elevated Security Frameworks: The employment of PISP API, coupled with its stringent user authentication protocols, erects barriers against fraudulent maneuvers. This move ensures the safety of digital payments, possibly encouraging widespread adoption of internet banking.

Impact of AISP API Activation Within the Finance Sphere

The AISP API holds a pivotal position in the architecture of open banking. Its utility doesn't cease at enabling non-banking entities to review consumer's fiscal data, with his/her permission. A range of effects color the financial universe owing to this.

- Supreme Financial Management: The AISP API presents a consolidated outlook on a customer’s scattered financial data across multiple banks. This panorama empowers users to strategize their assets adroitly.

- Bespoke Services: Receipt of user's account details equips external entities to design personalized finance-centered solutions. This degree of customization can elevate user contentment and loyalty.

- Increased Accountability: An AISP API bestows the reins of fiscal data to users, bestowing them with the power to make informed financial choices while maintaining strong accountability.

Comparative Features: PISP API and AISP API

Joint Influence of PISP API and AISP API on the Financial Sector

Fusing the powers of PISP API and AISP API, the financial structure may undergo a significant revolution. As these APIs streamline payments and demystify account details, they can craft a connected, smooth, and user-focused fiscal ecosystem. Such a fusion can kindle innovation, ignite competition, and radically upgrade the user's banking journey.

PISP API: Revolutionizing Digital Money Swaps

At the heart of open banking lies the PISP API, an acronym for Payment Initiation Service Provider. This indispensable component permits Third-party Providers (TPPs) to manage and control immediate financial exchanges sourced directly from a consumer's banking reservoirs. It evolves the payment ecosystem, sidestepping traditional means such as plastic money derivatives.

In the operational structure of PISP API, a durable digital communication path is established between the consumer's finance-residing bank and the TPP. On instigation of a payment cue by the consumer, this instruction is conveyed to the financial institution via the PISP API. Following a meticulous validation of the consumer, the transaction obtains eligibility once the authentication step is successfully executed.

The benefits of this approach proliferate in various directions. Firstly, it minces the expense load associated with transactional procedures by eliminating fees tied to card usage. Additionally, it amplifies the safety quotient of payment protections through its streamlined participant involvement. Primarily, by green-lighting direct bank account migrations without the need to involve card credentials, the consumer engagement sees a marked upgrade.

AISP API: Synthesizing Monetary Data

On the other end of the spectrum, the AISP API (Account Information Service Provider) gifts the TPPs with the capacity to compile and display a consumer’s macroeconomic data sourced from numerous banks. This consolidates into a cohesive visual snapshot of their financial health, empowering them to make informed monetary decisions.

The workflow of AISP API dictates a TPP to generate a request to the consumer's banks to procure relevant account intelligence. This gathered information is transported to the TPP via the AISP API, enabling them to organize these financial elements and present them to the consumer.

Viewed from a consumer's lens, this technique offers a panoramic view of their financial state, fostering efficient money management. Moreover, it aids in tailoring financial guidance suited to the consumer's fiscal environment. Crucially, it provokes a performance comparison among banks, inciting a competitive spirit that aids consumers in selecting the most beneficial services.

PISP API and AISP API: Differing Capabilities

Although both PISP API and AISP API serve as catalysts for the advance of open banking, they showcase considerable variations in functionalities and practical applications. Here's a distillation of their varying capabilities:

PISP and AISP APIs are disruptors in the traditional banking structure, demonstrating benefits like express transaction execution, encompassing financial cognizance, heightened transaction security, enhanced consumer experiences, and fuelled banking rivalry.

A New Banking Paradigm: PISP and AISP APIs

Pioneering the transformation in banking transactions and information management are PISP (Payment Initiation Service Provider) APIs and AISP (Account Information Service Provider) APIs, respectively. These innovative tools have become the cornerstones of futuristic banking, providing a streamlined, secure, and customer-oriented approach.

PISP API: The Engine Behind Swift Payments

PISP APIs, functioning as the driving pulse of 21st-century banking systems, delegate payment initiation rights to third-party providers (TPPs). Utilizing this mechanism, customers no longer need to navigate a bank's interface to carry out payments; they can do so directly from TPP platforms like e-commerce websites, finance management applications, or digital wallets.

PISP APIs harbor multiple advantages. They decongest the payment procedure, accelerate transactions, and remove the necessity for customers to distribute their banking credentials to multiple platforms, reducing fraud susceptibility. Further, they promote healthy competition and motivate originality in finance, empowering TPPs to amplify their service offerings.

AISP API: The Helm Of Effectual Financial Overview

Contrarily, AISP APIs authorize TPPs to consolidate customers’ account data, allowing an integrated perspective on their financial information across multiple banks and accounts. This comprehensive view aids customers in effective financial management, informed decision-making, and utilization of bespoke financial services.

The benefits of AISP APIs are multipronged. They augment financial transparency for customers, offering an all-embracing view of their monetary health. Simultaneously, they spur competition and innovation, equipping TPPs to extend value-added facilities, which include budgeting aids, finance planning provisions, and custom financial advice to their arsenal.

Proactive Security Enhancement with Wallarm AASM

The evolution of PISP and AISP APIs has undeniably brought security threats under the spotlight, given their access to sensitive financial specifics that could catch the eye of cyber miscreants. As such, rigorous security enhancements are an imperative for both banks and TPPs.

This is precisely where Wallarm's API Attack Surface Management (AASM) steps in. Wallarm AASM - an ingenious, agentless detection mechanism, is custom-built for the API environment. It scrutinizes external hosts and their respective APIs, detects the absence of WAF/WAAP solutions, unearths vulnerabilities, and curbs API data breaches.

Wallarm AASM brings about critical attributes that can fortify PISP and AISP API security. It enables thorough inspection of the API attack surface, helping banks and TPPs marshal pre-emptive strikes against vulnerabilities. It also includes automated auditing features, enabling round-the-clock API monitoring for possible security discrepancies. Moreover, it delivers insightful remedial strategies for banks and TPPs to nurture their API defense strategy proactively.

For firsthand understanding or trial of Wallarm AASM, visit https://www.wallarm.com/product/aasm-sign-up?internal_utm_source=whats. Used prudently, Wallarm AASM can ensure that your PISP and AISP APIs, equipped to efficiently meet contemporary banking expectations, remain secure, reliable, and resilient.

FAQ

References

Subscribe for the latest news